how to reduce taxable income for high earners 2020

We will begin by looking at the tax laws applicable to high-income earners. Discretionary trusts allow you the opportunity to distribute income to lower tax-paying beneficiaries.

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

Charitable donations are an.

. This is a great video if. How to reduce taxable income for high earners 2020. High-income earners make 170050 per year.

Compare - Message - Hire - Done. Max out your retirement contributions There are limits. Find High Income Opportunities in Lower Rated Higher Yielding Bond Funds.

Apply For Tax Forgiveness and get help through the process. With a daf you can make a donation receive an immediate tax deduction and then recommend grants to be given from. Get the Help You Need from Top Tax Relief Companies.

Contribute significant amounts to retirement savings plans. How to Reduce Taxable Income 1. Ad You Dont Have to Face the IRS Alone.

But you cannot deduct more than 60 of your adjusted gross income AGI. Those who contribute the full amount each year qualify for a tax deduction on their taxable income. An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement.

High-income earners are generally professionals in their field. First a property with a good location may appreciate in value through time resulting in a capital appreciation. Second the yearly loss is typically compensable by other.

Here are a few ways to reduce your tax burden if youre a high-income earner. There is not an income limit to charitable donation deductions. These will help you take a deduction of 100000 to 1 Million per year.

Ad Thumbtack - Find a Trusted Tax Professional in Minutes. Tax-advantaged investments offer some sort of tax benefit. They ought to be.

How To Reduce Taxable Income For High Earners 2020. Strategies for lowering taxable income. An overview of the tax rules for high-income earners.

They have invested much time working towards the success they have achieved. Ad Learn How to Reduce Taxable Income and Get Rid of Your Tax Debt Today. Ad Explore High-Yield Income Funds To Help Investors Meet Their Unique Goals.

Take advantage of your 401k By contributing pre-tax money to your 401k. 50 Best Ways to Reduce Taxes for High Income Earners 1. One of the easiest and potentially most beneficial ways to reduce your taxable income is to contribute to a pre-tax retirement account such as an employer-sponsored.

Setting up a trust can be a great way to reduce your tax bill. This is especially true for high-income individuals as they are generally subject to much higher tax rates than most people. A married couple can reduce taxable income by 39000.

You may take an itemized. This can be tax exemption the ability to defer paying taxes on income or the ability to grow an investment. Luckily there are many tax strategies and planning opportunities.

Keep careful records on this one but basically youre allowed to rent your house out to anyone. In 2022 a higher standard deduction of 12950 for individuals and 25900 for joint filers makes it harder for high-income earners to find enough deductions to itemize going. This video gives a few suggestions on how to reduce taxable income in order to pay fewer taxes.

The Gulf nation began weighing up plans to introduce income tax on high earners two years ago as part of the finance ministrys 2020-2024 economic scheme and efforts to. July 24 2020 225242. Participate in employer sponsored savings accounts for child care and.

Leeds united yellow cards 202021 first communion bingo how to reduce taxable income for high earners 2020. The panel suggested in its annual report raising the top income tax rate or imposing an energy solidarity tax on high earners to help the government fund relief measures. As a high-income earner.

Using the expertise of the TPI Group youll be able to reduce your income taxes and find ways to let your money do some of the heavy lifting for you. An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement account. Thats a tax saving between 9360 24 marginal rate and 14430 37 marginal rate.

9 Ways For High Earners To Reduce Taxable Income 2022

25 Tax Reduction Strategies On How To Reduce Taxable Income For High Earners Sofi

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

Tax Reduction Strategies For High Income Earners 2022

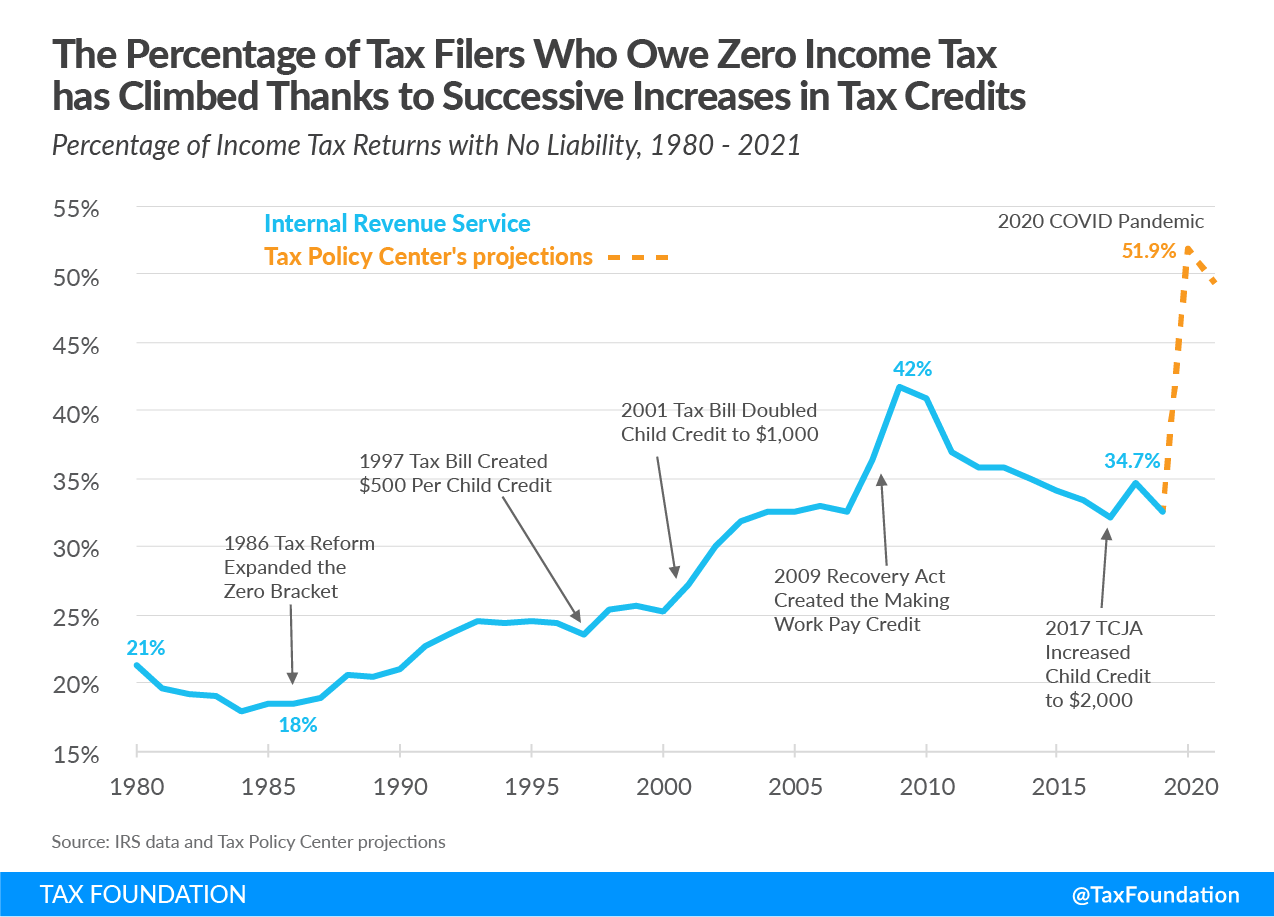

Increasing Share Of U S Households Paying No Income Tax

Be Ready For Big Changes 2021 Tax Planning

Tax Reduction Strategies For High Income Earners 2022

How To Reduce Taxable Income For High Income Earners In 2021

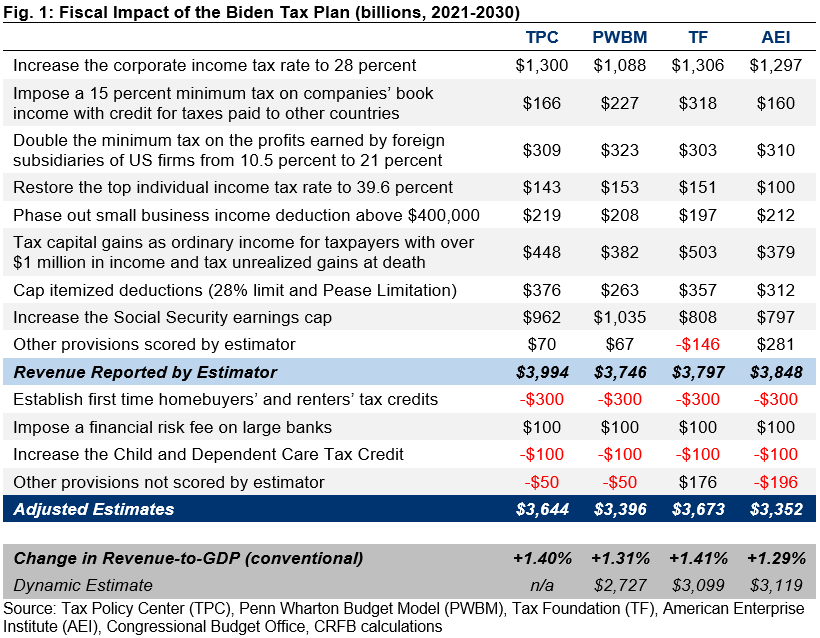

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

High Income Earner Tips To Optimize Your 2020 Tax Return Davis Wealth Advisors

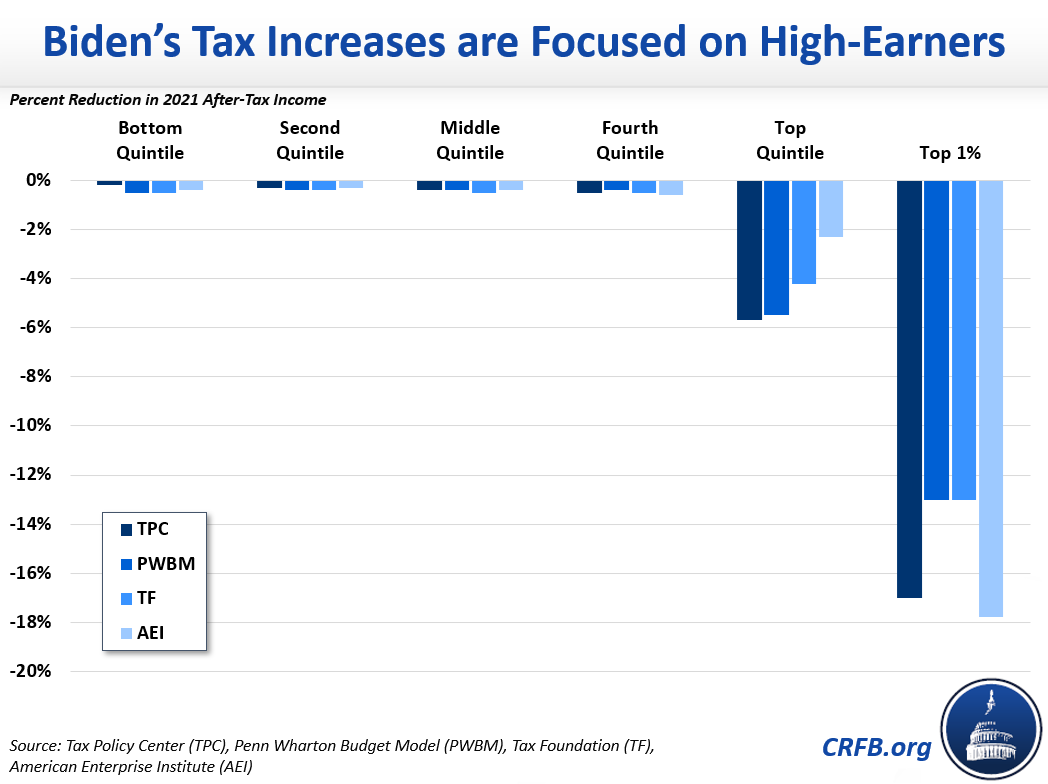

Would Joe Biden Significantly Raise Taxes On Middle Class Americans Committee For A Responsible Federal Budget

How To Reduce Taxable Income For High Earners 20 Ways White Coat Investor

Tax Strategies For High Income Earners Lalea Black

How Do Taxes Affect Income Inequality Tax Policy Center

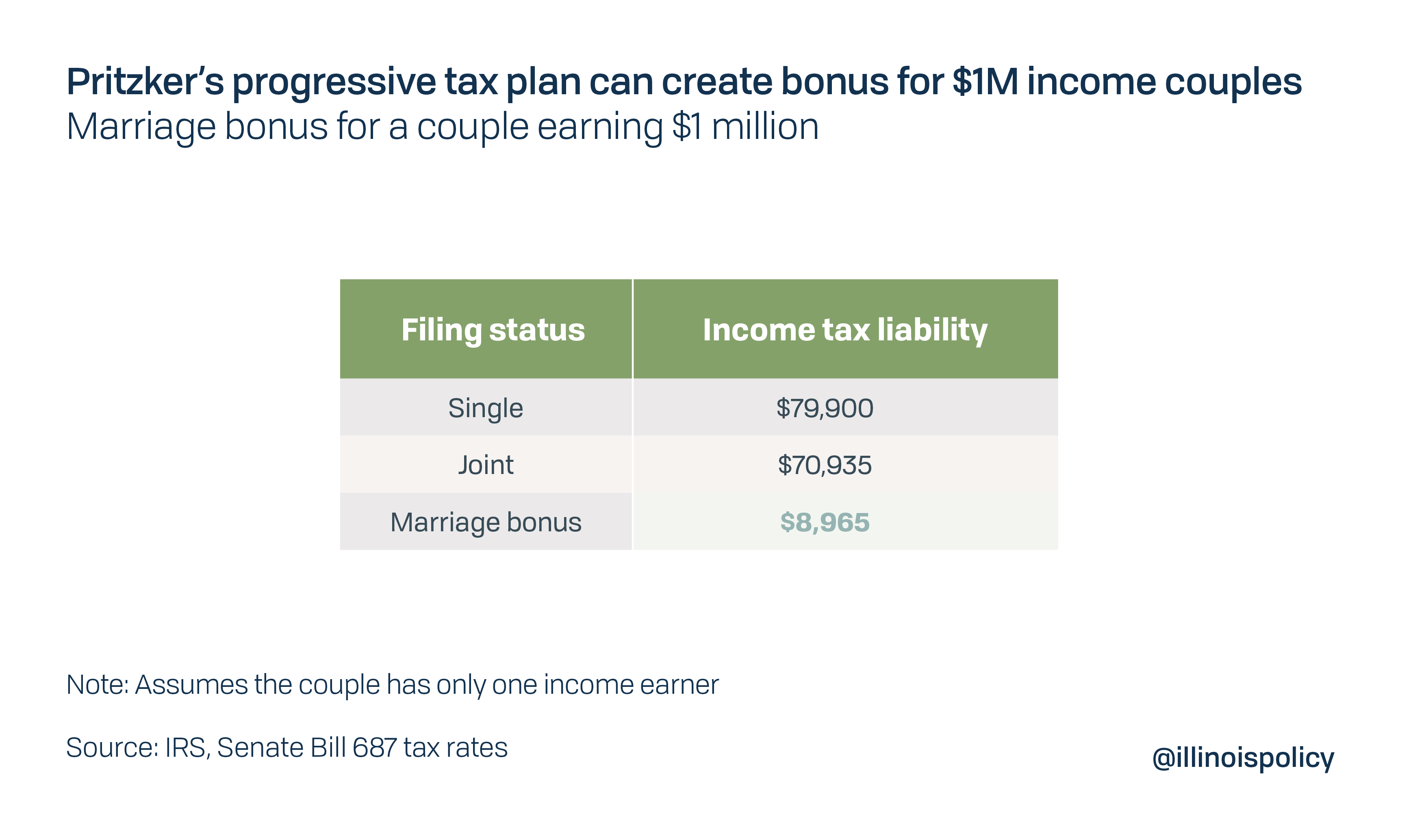

Pritzker Fair Tax Would Hit Over 4 Million Illinoisans With Marriage Penalty Potentially Give Wealthy Couples A Marriage Bonus

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

An Analysis Of Joe Biden S Tax Proposals October 2020 Update Grant M Seiter

U S Income Tax Policy Is Mostly About The 1 Justin Fox

How To Reduce Taxable Income For High Earners 20 Ways White Coat Investor