child tax credit payment schedule for october 2021

Thats an increase from the regular child tax. The irs will pay half the total credit amount in advance monthly payments beginning july 15.

Child Tax Credit Updates Why Are Your October Payments Delayed Marca

Fast And Easy Tax Filing With TurboTax.

. The 2021 advance monthly child tax credit payments started automatically in July. You received advance Child Tax Credit payments only if you used your correct SSN or ITIN when you filed a 2020 tax return or 2019 tax return including when you entered. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

Eligible families began to receive payments on July 15. Ad You Can Estimate Your Tax Refund Date With TurboTax. Besides the July 15 payment payment.

SEE MORE Child Tax Credit Payment Schedule for the Rest of 2021. Canada workers benefit CWB - advance payments All payment dates. You can use the IRSs Child Tax Credit Update Portal to change the bank account information the IRS has on.

13 opt out by Aug. Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. The complete 2021 child tax credit payments schedule.

Filed a 2019 or 2020 tax return and. Even though child tax credit payments are scheduled to arrive on certain dates you may not. Use schedule 8812 form 1040 to figure your child tax credits to report.

That drops to 3000 for each child ages six through 17. Up to 300 dollars or 250 dollars depending on age of child. Half of the total is being paid as.

Ad You Can Estimate Your Tax Refund Date With TurboTax. October 29 2021. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

15 opt out by Aug. Who is Eligible. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic E These updated FAQs were released to the public in Fact Sheet.

Start And Finish In Just A Few Minutes. So parents of a child under six receive 300 per month and parents of a child six or. The advance is 50 of your child tax credit with the rest claimed on next years return.

Up to 300 dollars or 250. The IRS is paying 3600 total per child to parents of children up to five years of age. Wait 10 working days from the payment date to contact us.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000. Ad The new advance Child Tax Credit is based on your previously filed tax return. After October two more monthly payments remain and then the last half can be claimed on the 2021 tax return.

Some have already chosen to unenroll from the monthly. The schedule of payments moving forward will be as follows. Start And Finish In Just A Few Minutes.

As part of the. Fast And Easy Tax Filing With TurboTax.

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Child Tax Credit Dates Next Payment Coming On October 15 Marca

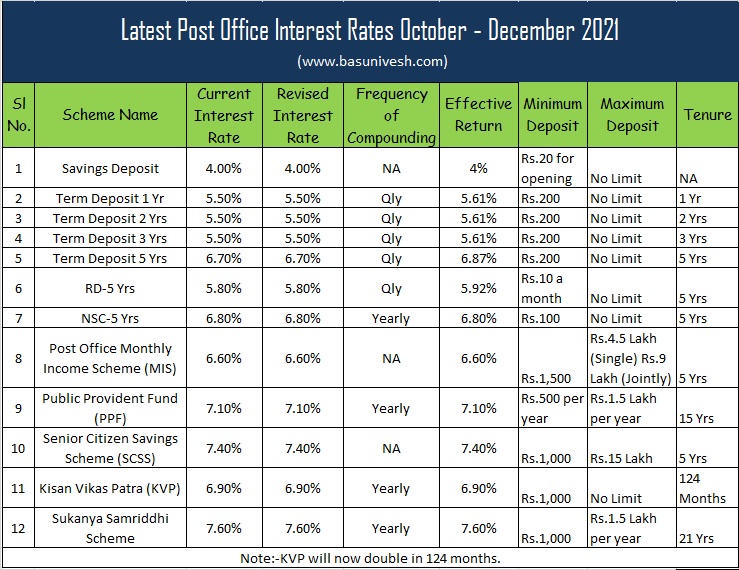

Latest Post Office Interest Rates October December 2021 Basunivesh

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

The Next Deadline For Opting Out Of The Monthly Child Credit Payments Will Be Here Soon Use The Irs S Child Tax Cred In 2021 Child Tax Credit Tax Credits Tax Deadline

Life Insurance Message Template 1 Advantages Of Life Insurance Message Template And How You Life Insurance Policy Life Insurance Life Quotes