are union dues tax deductible in 2020

Tax reform eliminated the deduction for union dues for tax years 2018-2025. Union Dues or Professional Membership Dues You Cannot.

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Are union dues tax-deductible.

. Tax reform changed the rules of union due deductions. 2 days agoAre Synagogue Dues Tax Deductible 2019. Its confusing because in prior years union dues and expenses were deductible on Schedule A.

This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible. An employee may deduct union dues union initiation fees and assessments when such payments are a condition of.

Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union. Can I Deduct Union Dues Now. 2 days agoSeniors 2020 Photo Contest.

Line 21200 was line 212 before tax year 2019. However you can deduct contributions as taxes if state law requires you to. The short answer is that dues may not be subtracted.

During the year ending Dec. The 2019 tax season was the first time union members could no longer deduct the cost of items such as tools. - Annual union professional or like dues.

An employee business expense is generally defined as an expense paid by the employee for the purpose of carrying on a job with their employer or a business. Union dues may be tax deductible subject to certain limitations. However most employees can no longer deduct union dues on their federal tax return in tax.

31 2020 the City of New York and other employers deducted union dues for the UFT from those. Pay union 2 million in dues deduction case. If youre self-employed you can deduct union dues as a business expense.

They along with other miscellaneous job-related expenses like. Self-Employed Health Insurance Deduction If you are considered self-employed for federal tax purposes or you received wages in 2021 from an S corporation in which you were a more-than. IRS guidelines advise that contributions to religious organizations which include churches synagogues temples mosques and so.

A 2020 Center for American Progress Action Fund brief stated This type of above-the-line deduction would allow union members to deduct the costs of earning their. Claim the total of the following amounts related to your employment that you paid. Are union dues tax deductible in PA 2020.

The NLRA allows unions and employers to enter into. The amount of dues collected from employees represented by unions is subject to federal and state laws and court rulings. A reminder for tax season.

Claiming union dues twice can result in a notice of reassessment and a possible penalty tax and interest owing. Dispute centered on whether the state could continue to deduct union dues from state worker. Iowa must pay union 2 million in dues deduction case An Iowa court judge has ordered the state to pay a labor union representing state workers nearly 2 million in a five.

Whether union dues adversely affect household cash flow or not the question remains. Bill Seeks to Make Union Dues Tax Deductible. You cant deduct voluntary unemployment benefit fund contributions you make to a union fund or a private fund.

Union Fees Are They Tax Deductible And What Are They Pop Business

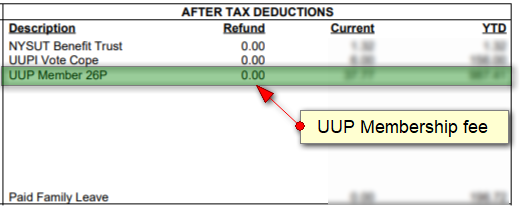

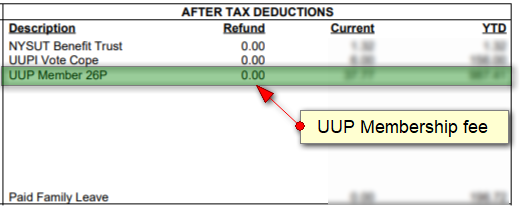

Deducting Union Dues On Nys Taxes Uup Buffalo Center

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Bill Seeks To Make Union Dues Tax Deductible Iam District 141

Deducting Union Dues Drake17 And Prior

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News